New Delhi :

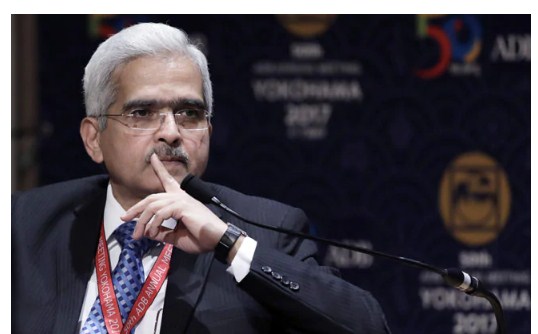

New measures to allow Indian lenders to restructure loans will provide a “durable” resolution for cash-strapped businesses and help revive the economy, according to the central bank’s chief. “On one hand health of banks is very important and on the other hand businesses are under a lot of stress due to covid,” Reserve Bank of India Governor Shaktikanta Das said in an interview

The plan has replaced a blanket loan moratorium that’s due to expire later this month, he said. Speaking in Hindi, Mr Das said the moratorium was a “temporary solution” for lockdown and not a permanent fix.

Authorities are looking to support an economy that’s been hit hard by the coronavirus, while ensuring the stability of a financial sector where bad-debt is set to swell to a two-decade high. Banks are struggling to accelerate credit growth to revive the economy, which is set for its first annual contraction in more than four decades. Lenders are also dealing with a pile of bad debt that was high even before the pandemic.

“We are trying to ensure that such businesses can get some regulatory help via banks on the loans that they have taken,” Mr Das said. “That will help the businesses to revive, jobs will be saved and in turn will help in economic revival.”

Addressing concerns that there could be a spike in bad loans once the six-month loan repayment freeze ends on Aug. 31, Das said banks will be able to extend or provide a new moratorium to borrowers under the new plan.